This suggests two main options:

1) how you calculate the cost of your stored items (Standard vs Average vs Real Price);

2) how you had a book value of inventory into your (periodic vs. perpetual).

Odoo allow any method. The default is "Standard price". Unfortunately, most companies use the FIFO (first-in-first-out) method to handle inventory whereas standard price cannot used here. Therefore we need to change from the standard price to the real price to make it as FIFO method.

To change this,

1) go to Purchases > Settings > Costing methods.

Click on the radio button "Use a 'Fixed', 'Real' or 'Average' price costing method". Don't forget to click button Apply.

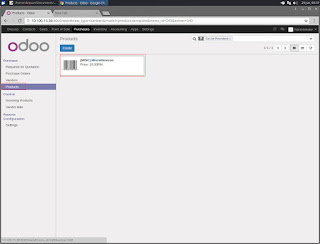

2) Then, go to Products and click any product show there.

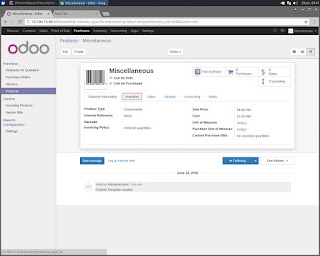

Product form will appear suddenly. Click on Inventory tab

and proceed to Internal category. Click at "All".

Click button Edit to edit/change Costing Method.

Yes, changing the costing method to be FIFO by selecting Real Price there as shown below. Lastly, please click button "Save".

Done.

you can also refer to the documentation website Odoo more on How to do an inventory valuation (continental accounting)

Sign up here with your email

ConversionConversion EmoticonEmoticon